Iran is the land of impossibles! It has its specific economics, social science, psychology and management rules. Now, I’m gonna write about an interesting phenomenon that’s happening these days in the Tehran Stock Exchange market.

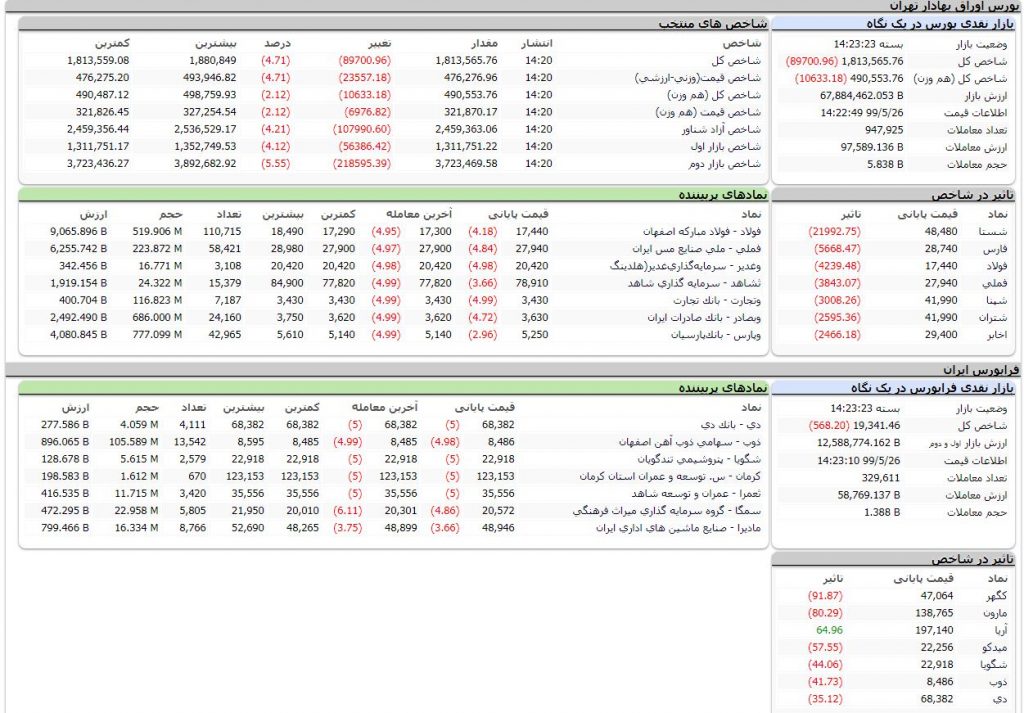

The Tehran Stock Exchange (TSE) market, which is known as “bourse” in the local language, was established in 1967 with about 10 registered public companies. The total market value is now standing around 7.5 million billion Tomans (about 375 billion dollars) with about 1.8 million exchange transactions and 16000 billion Tomans in average daily trade (last month) and the number of present companies has reached to more than 500. I’m trading in the market indirectly since seven years ago through several mutual funds. Thus, I’m not really an expert but I can write a short essay about that.

Every day from Saturday to Wednesday the TSE market opens from 8:30 until 12:30. In recent years, the stock market has been developed considerably hosting various types of securities such as stocks, options and priorities, and different financial tools such as ETFs, VCs, etc. There are also “product” and “energy” markets in which assets such as steel, gold, and oil are sold.

Common trading behavior

Unfortunately, there’s no opportunity in the national education system for learning the necessary trading skills in the stock market. Many people don’t absolutely know anything about this market and how it actually works (I think it’s partly because the risk threshold of investment for a normal Iranian isn’t so high). Last year, the number of people with active trading code was only 11 million in the country (about one-eighth of the population) out of which only less than 2 million were active traders. Even the ones who are active in the market may not have enough skills. There are many pages and channels on Instagram, Telegram, etc. that guide others about what to buy and when to sell stocks (known as showing “signal” in the popular language!). So, it’s not something strange to say that the majority of traders don’t analyze what they buy and sell fundamentally or technically and even they don’t know how to do it. As a result, emotional herding behavior is very common.

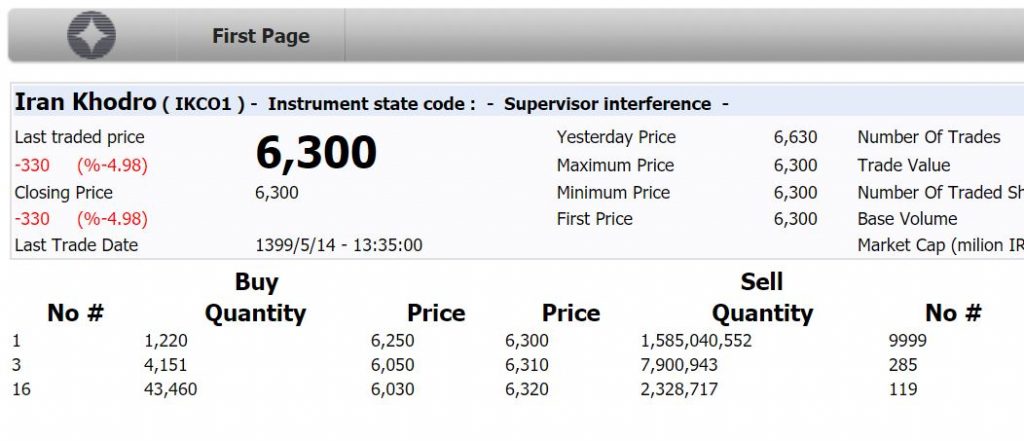

To address this ‘psychological market failure’, there’s a general range limitation of -5% to +5% for the stock price variations in each day -there are some exceptions that decrease or increase this range. This rule sometimes causes making one-sided “queue” for sales or bought for particular securities. That happens for example, when everyone wants to sell their stock in a particular symbol but there’s no one present to buy that for a price more than or equal to -5% (The same phenomenon may happen when everyone wants to buy but there’s no seller in this range).

What’s happening these days?

This year, Tehran Stock Market is experiencing an unprecedented situation. The stock price is following the recent devaluation of the national currency that happened in recent years making a superficial growth in every share. Furthermore, the monetary policymakers are directing the high liquidity to the stock market rather than the commodity markets. Also, the government is running a new policy of selling excess shares of state-owned companies at attractive prices in the market (The policy is the solution of the government due to the severe budget deficit in the country). Moreover, the registration process for new trader entrance and general IPO process for private companies is so facilitated and now there’s on average one IPO each week in the market. The national TV is also promoting the profitability of the stock market encouraging many people to enter. All these resulted in monthly about 1 million new registers and the number of active traders is more than doubled. And the whole market size has grown around 680% is the last year! (Note that Iran GDP growth was reported -7% last year!)

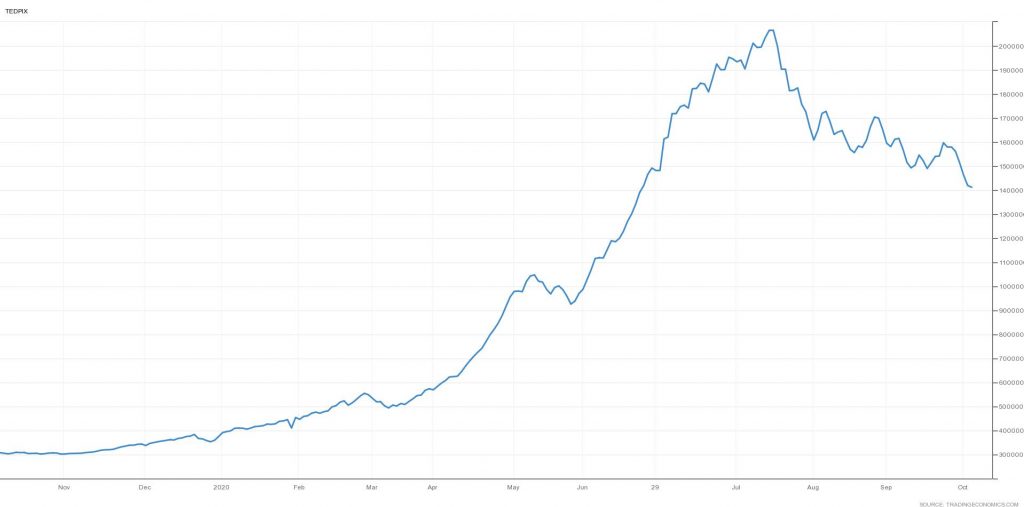

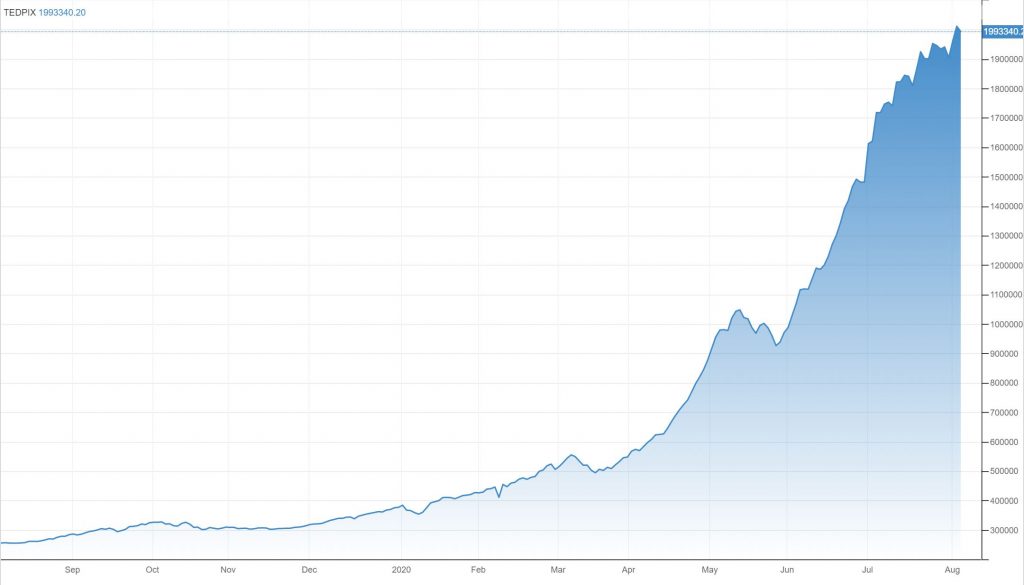

TEDPIX in Tehran Stock Exchange Market in the last year (Source: https://tradingeconomics.com/iran/stock-market).

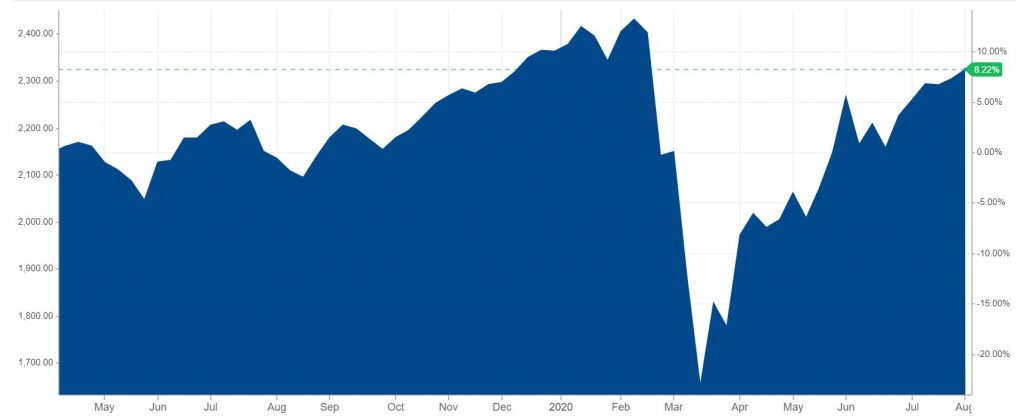

World MSCI Index in the last year (Source: https://markets.businessinsider.com/index/msci-world).

Compare the trends esp. during the COVID-19 western peak! Some try to describe it by the isolation of Iranian economy as a result of the American sanctions.

About 10 years ago, when the national income was on its peak due to the high global oil price, the Iranian government sold shares of the large public companies to people during a project called “Sahame Edalat” (it literally means ‘justice shares’). The idea was benefitting benefit every member of the society from the oil value raise. The owners of Sahame Edalat didn’t have the authority to sell their shares but they benefitted from the paid dividends. Now in order to help people in COVID-19, this authority is being given in an incremental manner to the shareholders until the end of this year. That means about 45 million new members would enter the market in less than a year. Of course, without any specific training and knowledge. No one knows what will happen at the end, yet the common expectation in Iranian society is to keep raising up!

Read on NY Times: https://www.nytimes.com/2020/02/13/business/iran-stock-market.html

Update: A few days after my post, the market started a serious crash comparable to its previous sudden growth.